virginia estimated tax payments corporate

Taxable Payment Amount of Corporate Net Income Tax Payment. If west virginia taxable income is expected to be at least.

Free Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

After registering for Business iFile log in and follow the.

. How to File and Pay Annual income tax return. If your estimated tax liability is more than 600 and your primary income source is wage and salary income you may want to adjust your withholding. Certain Virginia corporations with 100 of their business in Virginia and federal taxable income of 40000 or less for the taxable year may qualify to electronically file a short version of the return eForm.

The federal corporate income tax by contrast has a marginal bracketed corporate income taxVirginias maximum marginal corporate income tax rate is the 10th lowest in the United States ranking directly below Missouris 6250. 2017 taxpayers who make estimated tax payments must submit all of. West Virginia State Tax Department Tax Account Administration Division PO Box 1202.

BIG LITTLE TOYS 1001 LEE ST E CHARLESTON WV 25301-1725 Letter Id. Make a Payment Bills Pay bills or set up a payment plan for all individual and business taxes Individual Taxes Make tax due estimated tax and extension payments. The interest waiver applies to any individual corporate or fiduciary estimated virginia income tax payments that are required to be paid during the period from april 1 2020 to june 1 2020.

Use Form 1120-W Estimated Tax for Corporations as a worksheet to calculate your estimated tax. Every corporation subject to state income taxation must make a declaration of estimated income tax for the taxable year. All corporations can file their annual income tax return Form 500 and pay any tax due using approved software products.

Corporate and Pass-Through Entity Taxes. Use electronic funds transfer to make installment payments of estimated tax. All corporation estimated income tax payments must be made electronically.

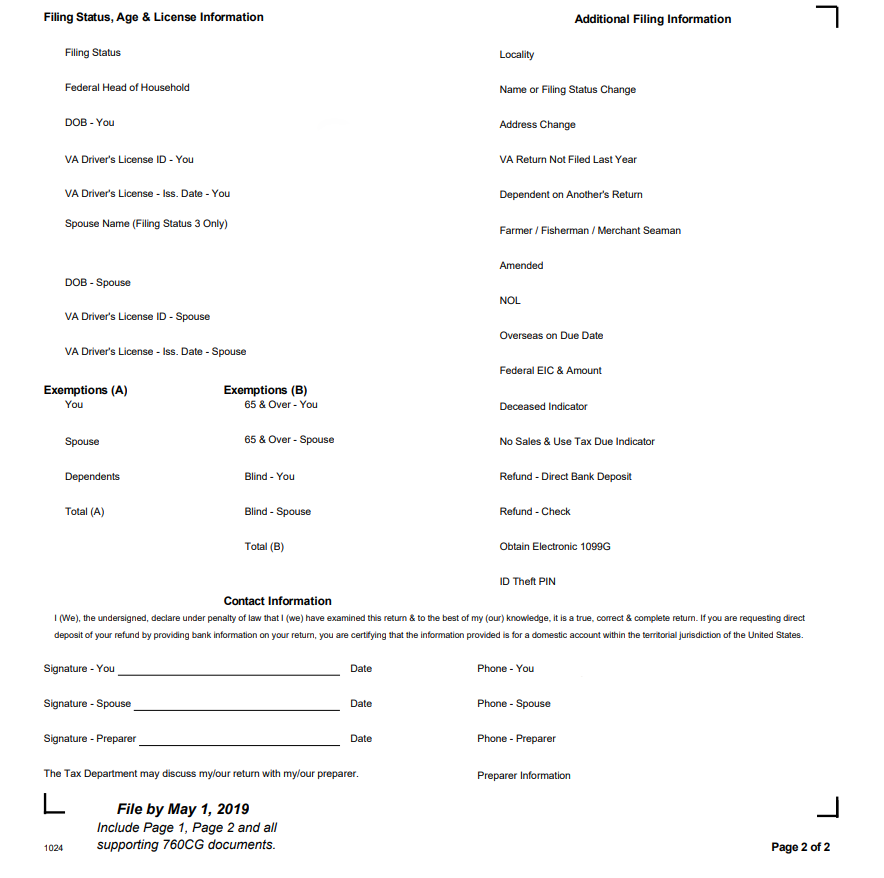

Figure the amount of their estimated tax payments. Download Or Email VA 760ES More Fillable Forms Register and Subscribe Now. Instructions for Form 760C Underpayment of Virginia Estimated Tax by Individuals Estates and Trusts 760F.

Form Instructions for Underpayment of Estimated tax by Farmers and Fisherman 770ES. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Business iFile is a free online service available 247 that offers a variety of options for the filing and payment of business taxes.

Use these vouchers only if you have an approved waiver. Corporations use Form 1120-W to. For Virginia tax purposes pass-through entities include.

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. Virginia Department of Taxation PO Box 27264 Richmond VA 23261-7264. Please note a 35 fee may be.

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. At least 90 of the tax liability is required. Follow the instructions.

Once the report is generated youll then have the option to download it as a pdf. Please enter your payment details below. An estimated payment worksheet is available through your individual online services account to help you determine your estimated tax liability and how many payments you should make.

At present Virginia TAX does not support International ACH Transactions IAT. Click IAT Notice to review the details. Virginia has a flat corporate income tax rate of 6000 of gross income.

Sales Use Taxes and Cigarette Tobacco Taxes. Corporations that are required to make estimated payments of their tax liability are subject to additions to tax for failing to pay at least ninety percent 90 of their annual tax. Apply for a quick refund if you overpay your estimated tax.

Virginia Estimated Income Tax Payment Vouchers For Estates Trusts and Unified Nonresidents 760C. CORPORATE NET INCOME TAX PAYMENT WEST VIRGINIA ESTIMATED WVCIT-120ES rtL066 v4 Account ID. 1546001745 At present Virginia TAX does not support International ACH Transactions IATClick IAT Notice to review the details.

At present Virginia TAX does not support International ACH Transactions IAT. Virginia Tax Electronic Payment Guide Rev. Are required to make estimated tax payments but wait until late in the tax year to make a lump sum payment will be penalized for not making the earlier required payments.

Virginia Estimated Income Tax Payment Vouchers For Estates Trusts and Unified Nonresidents 500NOLD and Instructions. A pass-through entity is any business that is recognized as a separate entity for federal income tax purposes and the owners of which report their distributive or pro rata shares of the entitys income gains losses deductions and credits on their own returns. Please enter your payment details below.

Pursuant to 581-4003 of the Code of Virginia certain electric suppliers are required to pay a minimum tax rather than a corporate income tax for any taxable year their minimum tax liability is greater than their corporate income tax liabilityThe minimum tax would be equal to 145 of the electric suppliers gross receipts minus the states portion of the electric utility consumption tax. Failure to pay estimated tax. All corporation estimated income tax payments must be made electronically.

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. IR-2022-77 April 6 2022 The IRS today reminds those who make estimated tax payments such as self-employed individuals retirees investors businesses corporations and others that the payment for the first quarter of 2022 is due Monday April 18. Log in and select Make an Estimated Payment See the instructions for Form 760 760PY or 763 for more on computing your estimated tax liability.

Check the sections youd like to appear in the report then use the Create Report button at the bottom of the page to generate your report. Virginia Department of Taxation PO Box 26627 Richmond VA 23261-6627. Corporation Income Tax 23VAC10-120-460.

West Virginia Corporation Net Income Tax Returns should be mailed to. 1052017 Page 2 of 18. Please enter your payment details below.

Form 500ES Corporation Estimated Income Tax. Virginia Department of Taxation PO Box 1500 Richmond VA 23218. Use Form 4466 Corporation Application for Quick Refund of Overpayment of Estimated Tax.

Individual Estimated Tax Payments - Virginia. Virginia estimated tax payments corporate. File a new Form IT-.

Corporate and Pass-Through Entity Taxes. Any installment payment of estimated tax exceeds 2500 or Any payment made for an extension of time to file exceeds 2500 or The total income tax due for the year exceeds 10000 If any of the thresholds above apply to you all future income tax payments must be made electronically.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Pay Online Chesterfield County Va

Instructions On How To Prepare Your Virginia Tax Return Amendment

It S Tax Season Use Your Refund To Jump Start Your Down Payment Savings Tax Season Tax Refund Tax Time

Virginia Dpb Frequently Asked Questions

Seller S Net Sheet Explained How To Project Your Home Sale Proceeds Printable Worksheets Cost Sheet Good Faith Estimate

Estimated Tax Penalty Usually Applies When A Taxpayer Pays Too Little Of Their Total Tax During The Year Each Year Around 10 Million T How To Apply Tax Avoid

Prepare And Efile Your 2021 2022 Virginia Income Tax Return

Tax Tip Have Virginia State Tax Questions Virginia Tax

Where S My Refund Virginia H R Block

Tax Tip Have Virginia State Tax Questions Virginia Tax

Virginia S Individual Income Tax Filing Extension Deadline For 2020 Taxes Is Nov 17 2021 Virginia Tax

Publication 926 2020 Household Employer S Tax Guide Internal Revenue Service Tax Guide Online Taxes Fun Things To Do

Va Disability Pay Schedule 2022 Update Hill Ponton P A

How To Make Tax Time Easy On Your Blog Or Va Business Tax Time Blogging Advice Estimated Tax Payments

How Save Money On Your Self Employed Taxes Estimated Tax Payments Money Basics Small Business Finance

West Virginia Vehicle Registration Dmv 1 Tr West Virginia Virginia Fillable Forms

Virginia Dpb Frequently Asked Questions

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic